How To Reimburse Employees For Electric Vehicles In Pa. A salary sacrifice scheme for electric cars is an employee benefit that allows your team to lease a new electric car while saving on taxes. The irs sets a mileage reimbursement rate employers can use to cover the deductible costs of operating an automobile for business purposes for employee.

The good, the bad, and the ugly. However, since the irs has yet to set mileage reimbursement rates for electric vehicles, you’re likely curious as to how to manage your.

The Good, The Bad, And The Ugly.

A salary sacrifice scheme for electric cars is an employee benefit that allows your team to lease a new electric car while saving on taxes.

The Transition To Electric Vehicles Is Forcing Employers To Review Their Fleet Policies For Reimbursing Drivers For Business Mileage.

Your employer leases the car from the.

Dep Offers A Rebate To Pennsylvania Residents Who Purchase Electric Vehicles Or Other Alternative Fuel Vehicles.

Images References :

Source: www.moveev.com

Source: www.moveev.com

MoveEV Launches ReimburseEV™ Reimburse Employees for Charging, Additionally, the irs standard mileage rate for 2024, at 67 cents per mile, offers a simpler, yet comprehensive, method. It can also prove to be a significant cost savings opportunity for the company and its employees.

Source: allstarcard.co.uk

Source: allstarcard.co.uk

How do you accurately reimburse electric vehicle (EV) mileage? Allstar, Irs rules require employers to impute taxable wage income to employees for employees’ personal use of company vehicles. Wondering what the regulations apply when it comes to reimbursing home charging costs incurred by fleet drivers in electric vehicles across different states?

Source: themilesconsultancy.com

Source: themilesconsultancy.com

EV fuel reimbursement guide, Here are several more advantages to charging evs at home: August 4, 2023 • by david lewis, moveev •.

Source: insights.leaseplan.co.uk

Source: insights.leaseplan.co.uk

Getting Started Reimbursement for Electric Vehicles LeasePlan Insights, For the final 6 months of 2022. Employers have several methods to.

Source: www.lsbf.org.uk

Source: www.lsbf.org.uk

HMRC outlines how businesses can reimburse electric car usage by employees, For more information about federal workplace charging, see femp’s federal workplace charging program guide and its federal workplace charging tools, case studies, and. Decreases reliance on public charging.

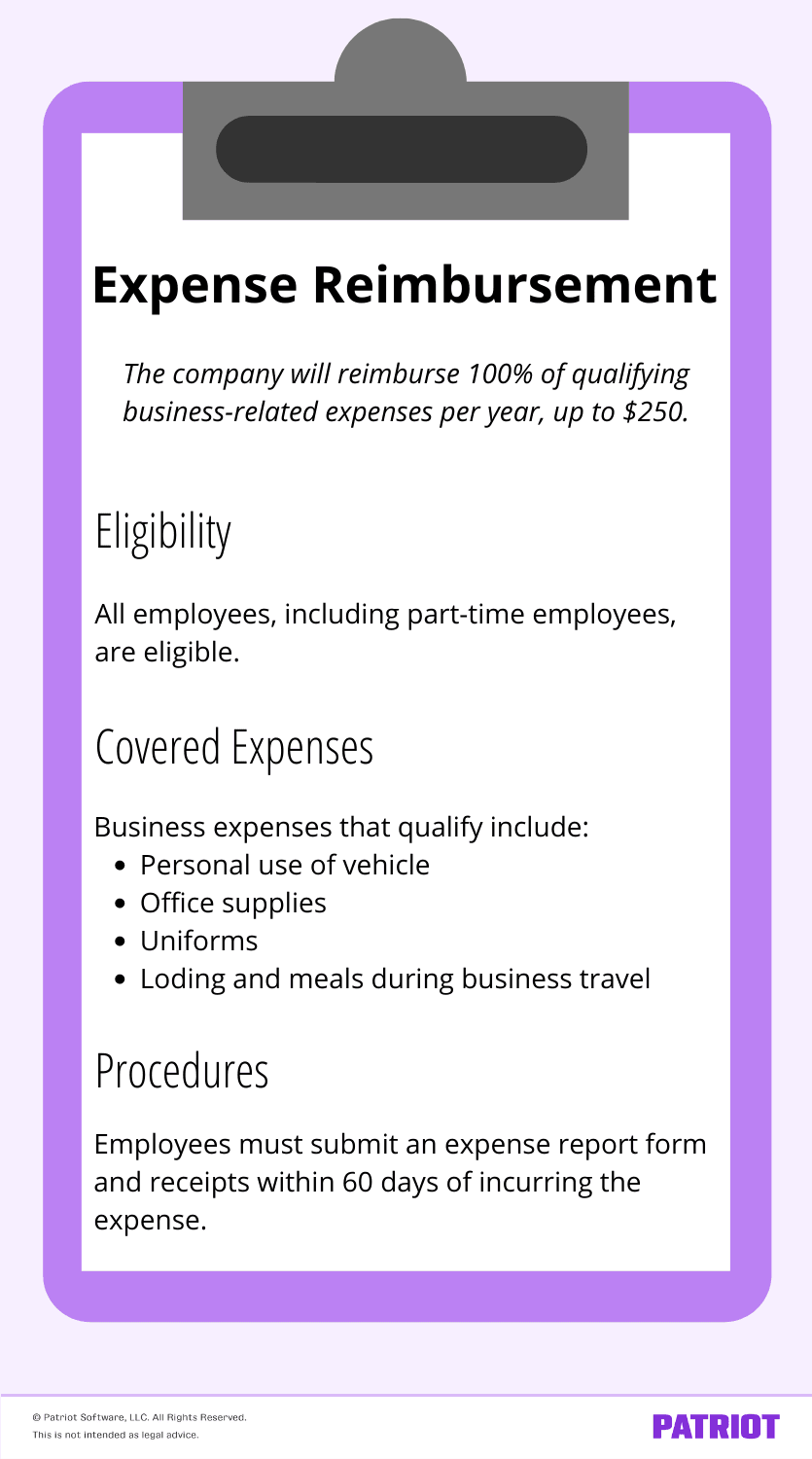

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Employee Expense Reimbursement Definition, Taxes, Policy, Saves unnecessary trips back to the fleet yard. It can also prove to be a significant cost savings opportunity for the company and its employees.

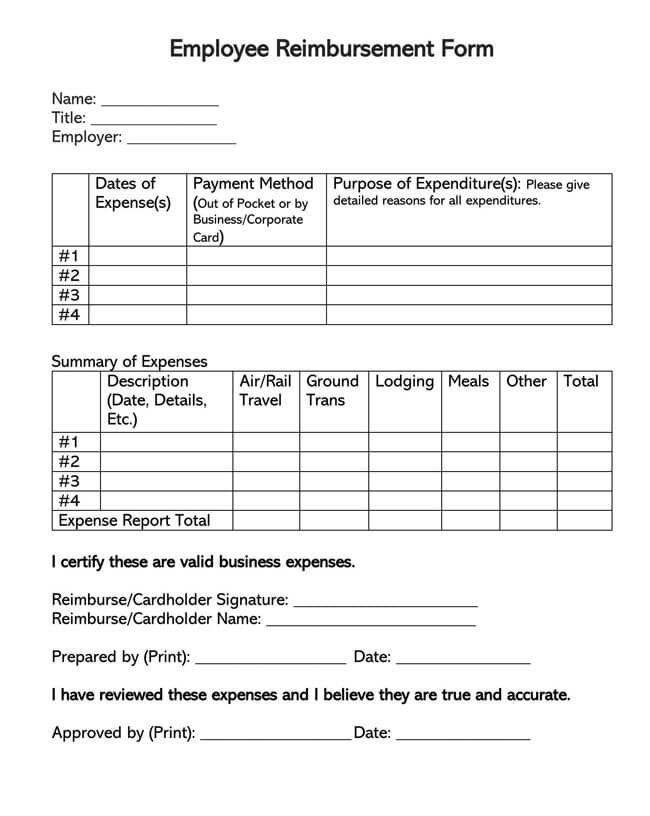

Source: mungfali.com

Source: mungfali.com

Employee Reimbursement Forms Free Printable, Employers have several methods to. Three ways to reimburse employees for ev home charging:

Source: www.automotive-fleet.com

Source: www.automotive-fleet.com

How To Reimburse Electric Vehicle Drivers for Charging at Home Green, August 4, 2023 • by david lewis, moveev •. Three ways to reimburse employees for ev home charging:

Source: www.youtube.com

Source: www.youtube.com

How to Manage Driver Reimbursement for Electric Vehicles Ford Pro™ E, Additionally, the irs standard mileage rate for 2024, at 67 cents per mile, offers a simpler, yet comprehensive, method. Here are several more advantages to charging evs at home:

Source: legaltemplates.net

Source: legaltemplates.net

Free Employee (Expense) Reimbursement Form Legal Templates, Saves unnecessary trips back to the fleet yard. For more information on these rebates and other ways to help make an electric vehicle fit your budget,.

For The Final 6 Months Of 2022.

Irs rules require employers to impute taxable wage income to employees for employees’ personal use of company vehicles.

But Reimbursement For Business Mileage Is The Tip Of The Iceberg When It.

Dep offers a rebate to pennsylvania residents who purchase electric vehicles or other alternative fuel vehicles.